Rich Dad Stock Blog

Free Information to Help You Build Wealth in the Stock Market

Tag Archives: rich dad

Of Chains and Teeter-Totters: Diversification

Diversification is trumpeted as an essential piece of the investing puzzle. Financial preachers of all types and stripes admonish the retail masses to spread their investing eggs among all sorts of baskets to avoid losing too much money due to a single unforeseen basket drop. And yet, it’s not enough to simply buy five different stocks or three different asset classes unless you know just how related they truly are.

Diversification without thoughts of correlation is folly.

Back in the day when I was fine-tuning my financial prowess, I would watch Jim Cramer’s Mad Money on CNBC to expand my vocabulary and better grasp how market veterans converse about investing. One of the segments was called Am I Diversifed? and involved multiple callers spouting off their stock holdings then asking whether or not they possessed a diversified portfolio. While many no doubt found Cramer’s responses enlightening, the reality is measuring diversification can be a simple task with the right tool – a correlation indicator.

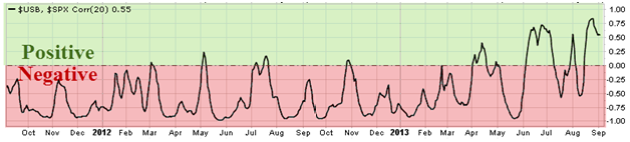

The correlation study ranges between +1.00 and -1.00 with +1.00 representing a perfect positive correlation and -1.00 representing a perfect negative correlation. If two assets have a +1.00 correlation it means they move in the same direction 100% of the time. Each day asset A rises, so too does Asset B.

Like links in a chain positively correlated assets move in lockstep.

In contrast, assets boasting a -1.00 correlation move in opposite directions 100% of the time. When one zigs, the other always zags.

In the financial playground these inversely related securities sit on opposing sides of the teeter-totter.

Finally, when the correlation study resides close to zero both assets in question have little distinguishable relationship. Which is to say the behavior of one offers little insight into the behavior of the other.

Source: Stockcharts.com

Suppose an investor buys three different securities: SPY, MDY, IWM. The SPY represents large-cap U.S. stocks, MDY represents mid-cap U.S. stocks, and IWM represents small-cap U.S. stocks. Are they diversified? Well, yes and no. Sure they own a mix of U.S. companies with varying size which on the surface appears diversified. And yet all three ETFs have a strong positive correlation. Odds are if one of them drops precipitously so too will the others.

A more diversified portfolio could be constructed selecting ETFs that boast a negative correlation such as stocks and bonds. Correlation also plays a crucial part in the realm of intermarket analysis, but such is a discussion for another day.

Tyler Craig, CMT

Rich Dad Education Elite Training Instructor

Five Reasons New Stock Market Traders Fail

Five Reasons New Stock Market Traders Fail

Experienced traders often envy the excitement and wonderment that the new trader experiences. Over the years, these experienced traders often develop systematic routines and have found the strategies that are best suited for their personalities and lifestyles. The veteran trader still enjoys their work, the flexibility of their job, and the profits that accompany it; however, their trading often becomes routine… even a touch boring at times. This boredom is usually the result of employing the same successful strategy, or taking advantage of the same successful trade setup, time and time again. The thrill that accompanied their early days may be long gone, but the veteran trader’s bank account has been well compensated.

It is hard to begrudge the veteran trader as they think about new traders as the early days, weeks, and months of trading are very exciting. During this early period new traders learn numerous concepts, develop charting skills and dream of original strategies. Often, a new trader will have a hard time falling asleep at night due to all of the ideas that are swimming around their head and thoughts of wealth just around the corner. These early days are indeed exciting, but few veteran traders would ever go back, no matter how tempting the thrill of doing it all over again may be. They wouldn’t go back because the reflective trader realizes the road to success in trading is a road that few traders are able to successfully travel.

When you read statistics on the percentage of traders who become successful, you get slightly varying reports. Sometimes you read that 90 percent of traders fail. Other times you read that 92 percent of traders fail to make money in trading. Sometimes you read that 94 percent of traders that attempt to become professional traders fail to do so. One can quibble over the statistics, but there are two truths that emerge out of all of these:

- The vast majority of traders that start out will fail on one level or another.

- While a much smaller percentage, there are traders who succeed.

For those new to trading, these two truths should simultaneously provide a great deal of comfort and a healthy dose of paranoia. They can take comfort in the fact that there are those that succeed and enjoy a level of prosperity that is life altering. They should also be aware and attempt to understand why so many traders fail so they don’t become yet another statistic.

There are numerous variables that can explain why traders fail, but there are a few common themes that emerge when examining failed traders. Here are some of the most common ones:

1) Lack of Education – It may seem self-serving for an education company to tell you that one of the most common reasons traders fail is lack of education, but it is the cold hard truth. The school of hard knocks is very expensive when it comes to trading. Many traders attempt to go on their own after reading a few articles on the Internet or reading a book. Even if the material they read is factually accurate, it can seldom help a new trader put trading within context and develop a systematic plan that can help them succeed in the market. A proper education cannot only teach you the factual knowledge you need, but it can also help you create a step-by-step plan to approach each trade you make.

2) Money Management – Perhaps no reason why traders fail is more devastating than improper money management. If a trader lacks passion for trading, then they usually fail because they quit trying, but little financial harm is done. If a trader fails because of improper money management, then it can wreak havoc on their finances. Most, if not all, of successful traders have developed rules and guidelines for the percentage of their capital they can place on a trade and the percentage of capital they can have in play in the market at any given time. Unfortunately, it is far too common for new traders to overextend themselves on a given trade and only think of what happens if it goes right. When the trade goes south, they sometimes wipe out all if not a large percentage of their working capital.

3) Lack of testing – Time and time again, instructors and mentors will tell their students to test their knowledge of a strategy through virtual trading or through the back testing of a strategy. Time and time again, new traders will ignore such advice jumping into the world of trading with live money. An argument can be made that live trades are better teachers and this may be the case. However, many times new traders learn from these teachers at a very high cost when the same lessons might have been learned for free through virtual trading. If you are a new trader and insist on live trading right away, make sure that your trades are small so the lessons you learn are not expensive.

4) Lack of Plan and/or Focus – There are thousands of stocks and dozens of strategies that you can utilize to become successful. You can also choose numerous indicators to assist you and employ various trading styles. There is no universally correct way to trade and this becomes a problem for some new traders. One day they will learn about call options and trade these for a few days. Then, they will learn about the Iron Condor and trade that for a week. One day they want to be a swing trader and the next day a day trader. One day the MACD is the best indicator on the planet only to be replaced by whatever indicator catches their eye next. While experienced traders can often use various trading styles and strategies to maximize their trading, they have gained the expertise needed to do so. New traders who jump around often fail to develop the needed expertise and are constantly making critical mistakes that lessen their chances of succeeding in the long term.

5) Improper Psychological Makeup – Some people are hampered by their own personality. Some traders are action junkies and are drawn to trading for the thrill of the action. New traders who are action junkies are usually severely punished as they are looking to trade, and not necessarily looking for great setups to trade. Other individuals cannot stand the thought of losing and exit trades too quickly or can never pull the trigger, no matter how great the trade setup may be.

It is amazing what a little patience, discipline, and self-awareness does to increase your chances of success in the world of trading. When you couple these attributes with a proper education, you will be well on your way to becoming part of the small percentage of traders who enjoy the tremendous rewards that trading can bring to their life.